ARK Addresses Wealth Managers’ Concerns | Fed Hits “Pause”: Accept the Macro, Focus on the Micro

On March 20 (Beijing time), the U.S. Federal Reserve opted to pause its rate-cutting cycle, holding the federal funds rate steady at 4.25%–4.50% for the second time since initiating monetary easing in September 2024. The decision, greeted with a rally in U.S. equities (Dow +0.92%, Nasdaq +1.41%, S&P 500 +1.08%), underscores a broader tension: While markets celebrate short-term liquidity, systemic risks—from geopolitical fragmentation to technological disruption—are reshaping the investment landscape. The 2025 First Half ARK Wealth CIO Report argues that wealth managers must now prioritize resilience over returns, anchoring strategies in a global, future-oriented, and values-based framework to navigate this era of uncertainty.

The Rising Tide of Global Risks

The report identifies four structural forces redefining wealth management:

Political and Economic Realignment: The return of Donald Trump to the White House has accelerated U.S. policies focused on “external security and internal efficiency,” including tariff hikes, manufacturing reshoring, and technology export controls. These measures deepen U.S.-China strategic rivalry, amplifying geopolitical risks.

Technological Innovation: The AI race—led by U.S. dominance in hardware (e.g., NVIDIA) and foundational models—is reshaping industries, but long-term risks (e.g., job displacement, ethical dilemmas) rank among the top six global concerns in the World Economic Forum’s 2025 Global Risks Report.

Demographic Shifts: Aging populations in developed economies and youth bulges in emerging markets create divergent growth trajectories, influencing labor markets, consumption patterns, and fiscal sustainability.

Climate Change: Extreme weather events (ranked #2 in the 2025 Risks Report) and geoeconomic fragmentation (#3) underscore the urgency of integrating sustainability into portfolios.

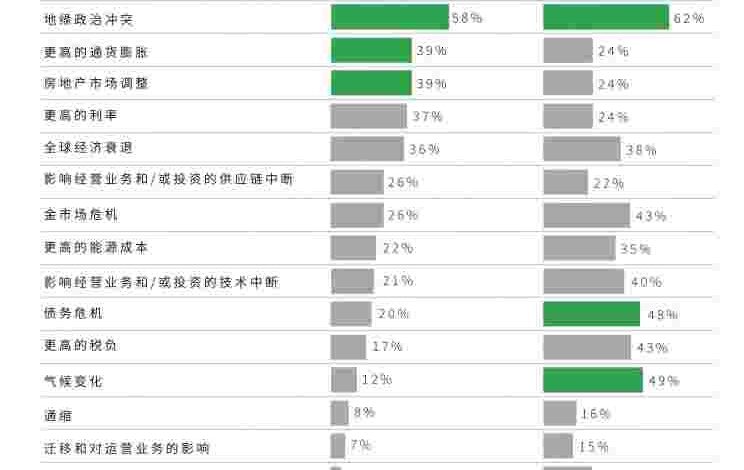

These risks are not hypothetical. UBS’s 2024 Global Family Office Report, surveying 320 single-family offices with $600+ billion in assets, found that 62% of respondents prioritize geopolitical tensions as their top concern over the next five years, followed by climate change (49%) and unsustainable public debt (48%).

From Short-Term Speculation to Long-Term Resilience

In this environment, the ARK CIO Report challenges wealth managers to abandon traditional “return-chasing” strategies in favor of multi-decade horizon planning. Key principles include:

Global Perspective: Adopt a comprehensive risk management system that integrates geopolitical, economic, and technological safeguards. For example, diversifying across regions and currencies to mitigate geoeconomic fragmentation risks.

Future Orientation: Align portfolios with long-term structural trends. The report highlights four critical forces to monitor:

Geopolitical: U.S.-China decoupling, trade blocs (e.g., EU, ASEAN), and supply chain resilience.

Technological: AI, quantum computing, and clean energy breakthroughs.

Demographic: Healthcare, education, and labor market adaptations.

Climate: Renewable energy, carbon pricing, and climate adaptation infrastructure.

Values-Based Framework: Embed wealth management within a broader family development strategy, enhancing not just financial capital but also intellectual and human capital. As Charlie Munger advised, “Macro is what we must accept; micro is where we can act.” This means leveraging financial markets for long-term growth while investing in family education, skills, and well-being.

The U.S.-China Strategic Rivalry: A Case Study in Market Volatility

The report underscores how U.S.-China tensions—exacerbated by Trump’s policies—are fueling asset price volatility. If proposed tax cuts and fiscal stimulus materialize, they could boost U.S. growth but also intensify inflation, tighten monetary policy, and heighten policy uncertainty. In such a scenario:

U.S. Equities: May benefit from growth but face headwinds from rising rates.

Bonds: Likely to underperform as yields climb.

Emerging Markets: Vulnerable to capital outflows and trade disruptions.

Alternative Assets: Real estate, infrastructure, and private equity may offer diversification benefits.

This underscores the need for dynamic, global asset allocation that balances risk and reward across regions and asset classes.

Building Resilient Portfolios: Three Pillars

The ARK CIO Report outlines a three-pillar approach to wealth management:

Capital Preservation: Prioritize low-volatility assets (e.g., short-duration bonds, gold) and structured products (e.g., Fixed Coupon Notes) to mitigate downside risk.

Income Generation: Seek yield in real assets (e.g., infrastructure, renewable energy) and dividend-paying equities.

Growth Exposure: Allocate to disruptive technologies (e.g., AI, biotech) and emerging markets via actively managed strategies.

Conclusion: The Path Forward

In an era of intersecting crises—geopolitical, technological, and environmental—wealth managers must evolve beyond traditional asset allocation. The 2025 First Half ARK CIO Report provides a roadmap: Embrace a global, future-oriented, and values-based framework to build portfolios that are not just resilient but also aligned with long-term prosperity. As the report notes, “Risk cannot be eliminated, but it can be managed through disciplined strategy, periodic rebalancing, and a commitment to enduring principles.”

For investors seeking to navigate this complex landscape, the full report offers in-depth analysis, case studies, and actionable strategies. The future of wealth management lies not in chasing returns but in building resilience—and that journey begins today.