9452285426 , 8339893918 , 8133053083 , 2076077884 , 7869051125 , 8035981004 , 3603469239 , 5854601091 , 3606265634 , 8555181732 , 8446772542 , 6472498929 Top Picks for Emerging Market Investments

The “6472498929 Top Picks for Emerging Market Investments” report identifies key sectors that are set to thrive amid evolving economic landscapes. It emphasizes technology trends such as artificial intelligence and blockchain, alongside healthcare innovations like telemedicine. These sectors not only promise substantial returns but also address critical accessibility issues. Investors must consider the companies that are strategically positioned within these domains. Understanding the nuances of these investments may reveal significant opportunities worth exploring further.

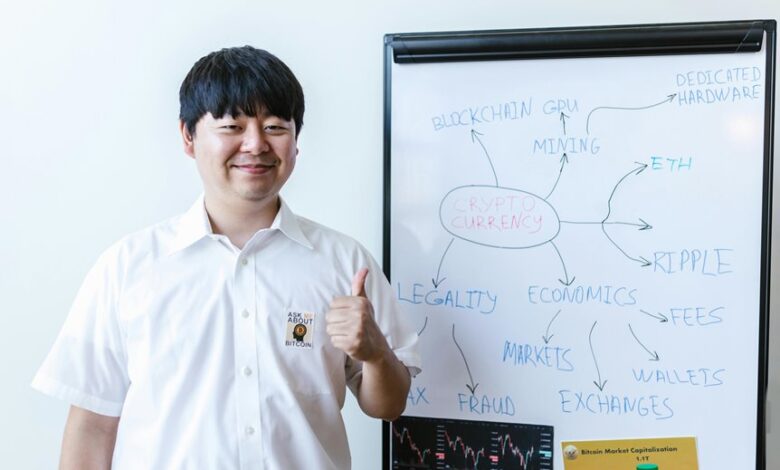

Key Sectors to Watch in Emerging Markets

A significant portion of investment opportunities in emerging markets is concentrated in specific sectors poised for substantial growth.

Notably, technology trends such as artificial intelligence and blockchain are reshaping economies, while healthcare innovations, including telemedicine and biotechnology advancements, are addressing critical needs.

These sectors not only promise lucrative returns but also align with a broader desire for freedom through improved accessibility and efficiency.

Promising Companies Driving Growth

While numerous companies in emerging markets are vying for investor attention, a select few are distinguished by their innovative approaches and robust growth prospects.

Notable among these are innovative startups that leverage technology to disrupt traditional sectors, alongside established market leaders that maintain competitive advantages.

Their ability to adapt and innovate positions them favorably, making them attractive options for discerning investors seeking growth opportunities.

Strategies for Investing in Emerging Economies

Investing in emerging economies requires a nuanced approach that accounts for the unique challenges and opportunities present in these markets.

Effective strategies encompass robust risk management techniques, such as diversification and thorough market analysis, to mitigate potential losses from currency fluctuations.

Investors should also remain informed about geopolitical dynamics, fostering a proactive stance that capitalizes on growth while safeguarding their financial interests against volatility.

Conclusion

In conclusion, the landscape of emerging market investments is ripe with opportunity, offering a veritable cornucopia of potential. By carefully selecting companies that embrace technological advancements and healthcare innovations, investors can navigate this vibrant terrain with confidence. Employing prudent risk management strategies ensures a balanced approach, allowing for both growth and security. As the world evolves, those who embrace these promising sectors will likely find themselves well-positioned to reap the rewards of their foresight and diligence.